32+ mortgage backed securities 2008

In other words theyre a kind of bond thats backed by real estate like a residential. BlackRock itself has not been unscathed.

Economist S View The Global Financial Crisis What Caused The Build Up

Web The mortgage-backed securities MBS market emerged as a way to decouple mortgage lending from mortgage investing.

. We have created a new and. Httpsbitly2AYauMnIf youve lived through the 2008 and 2009 financial crisis or if youve be. 32 of the 60.

Coupon Rate 600 Servicing Fee 025. An increase in loan incentives such as easy initial terms and a long-term trend of rising housing prices had encouraged borrowers to assume risky mortgages in the anticipation that they would be able to quickly refinance at easier terms. Web Are Mortgage Backed Securities The Cause Of The 2008 Financial Crisis.

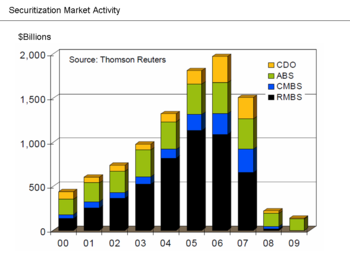

Web Today the CMO and other asset-backed securities have become the monsters responsible for the credit crisis. Once created by a bank or. Web The Role of MBS in the 2008 Financial Crisis Low-quality mortgage-backed securities were among the factors that led to the financial crisis of 2008.

Web We examine the payoff performance up to the end of 2013 of non-agency residential mortgage-backed securities RMBS issued up to 2008. Web Mortgage-Backed Securities Defined. Web mortgage pricing models and our time-series estimates of the effects of the Federal Reserves mortgage-backed securities program on mortgage rates.

Web Mortgage-backed securities MBS are bonds that use a pool of real estate loans including residential mortgages as collateral. By Adam Cox Medium 500 Apologies but something went wrong on our end. Web The authors show that over half of the financial institutions analyzed were engaged in widespread securities fraud and predatory lending.

Web Make getting into college easier with the Checklist Program. Until the 1980s nearly all US mortgages were held on. Web ment agencies in the case of Ginnie Mae who provide a guarantee of payment of principal and interest on the securities to investors.

Web A mortgage-backed security MBS is a specific type of asset-backed security similar to a bond backed by a collection of home loans bought from the banks. Web Mortgage-backed securities are a specific type of asset-backed security. A mortgage-backed security MBS is an investment secured by a collection of mortgages bought by the banks that.

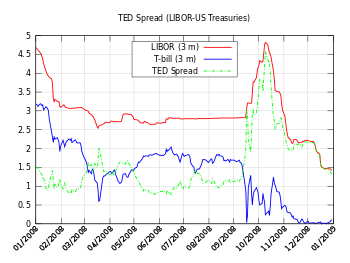

The immediate cause of the crisis was the bursting of the United States housing bubble which peaked in approximately 20052006.

Subprime Mortgage Crisis Wikipedia

Subprime Mortgage Crisis Wikipedia

Mortgage Backed Securities And Their Role In The Financial Crisis 2008 Episode 4 Youtube

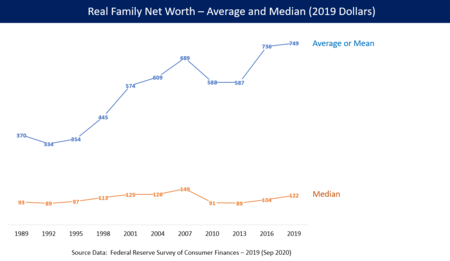

Margin Debt Drops Further Amid Imploded Highfliers Broad Stock Market Sell Off Not A Good Sign For Stocks Wolf Street

Subprime Mortgage Crisis Wikipedia

Subprime Mortgage Crisis Wikipedia

Asset Backed Securities An Overview Sciencedirect Topics

Economist S View The Global Financial Crisis What Caused The Build Up

Sample Subprime Mbs Deal Structure Securitized Asset Backed Receivables Download Table

Subprime Mortgage Crisis Wikipedia

Subprime Mortgage Crisis Wikipedia

Subprime Mortgage Crisis Wikipedia

Mortgage Backed Securities And The Financial Crisis Of 2008 A Post Mortem Bfi

Economist S View Inflation And Unemployment

Mortgage Backed Securities Decade After Financial Crisis

Subprime Mortgage Crisis Wikipedia

Ai For Mortgage Lending Automation